Legal framework of cross-sector investment review

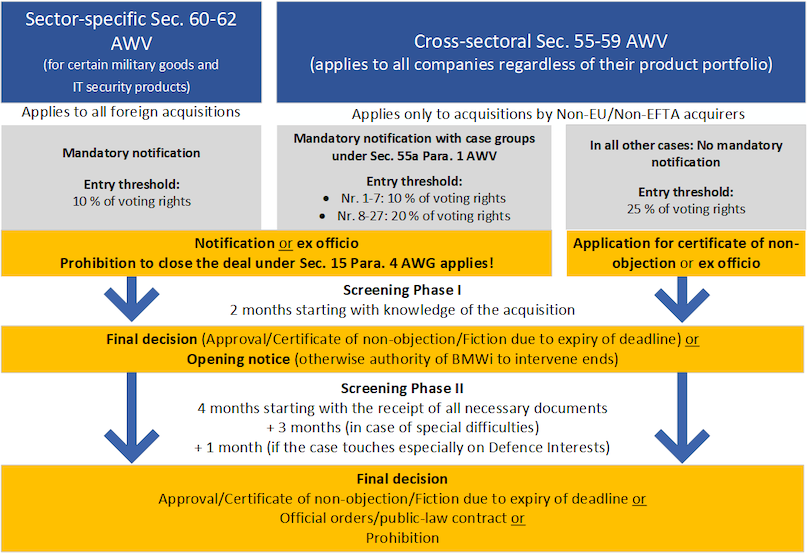

In principle, any acquisition of a company by investors located outside the territory of the EU or the EFTA region whereby investors acquire ownership of at least 25% of the voting rights of a company resident in Germany can be subjected to such review. If the domestic company operates critical infrastructure within the meaning of the Act on the Federal Office for Information Security, or if it provides other services of particular relevance to security within the meaning of Section 55 subsection 1 sentence 2 number 1 to 6 Foreign Trade and Payments Ordinance, the threshold for the review is only at least 10%. If the direct buyer is resident in the territory of the EU, such review may be performed if there are indications of an abusive approach or a circumvention transaction (Section 55 Subsection 2 of the Foreign Trade and Payments Ordinance).

The review considers whether the respective acquisition poses a threat to the public order or security of the Federal Republic of Germany, i.e. whether the acquisition represents a sufficiently serious and present threat which affects a fundamental interest of society. The text of the Act therefore refers directly to EU legislation and the case law of the European Court of Justice (ECJ). To date, the ECJ has acknowledged that public order or security may be affected by acquisitions related to issues such as security of supply in the event of a crisis, telecommunications and electricity, or the provision of services of strategic importance.

- Review procedure

Acquisitions in which the investor obtains at least 10% of the voting rights in a company which operates a specifically defined critical infrastructure or delivers certain services of particular relevance to security, in particular in conjunction with the operation of such infrastructure, must be reported to the Economic Affairs Ministry (Section 55 subsection 4 Foreign Trade and Payments Ordinance in conjunction with Section 55 subsection 1 sentence 2 number 1 to 6 Foreign Trade and Payments Ordinance). Apart from this, there is no requirement for investors to report or obtain approval. However, the Economic Affairs Ministry may ex officio conduct a review within two months from the time it became aware of the conclusion of the acquisition agreement (Section 55 Subsection 3 of the Foreign Trade and Payments Ordinance).

Irrespective of this, an investor may request a binding certificate of non-objection from the Economic Affairs Ministry (Section 58 of the Foreign Trade and Payments Ordinance) prior to the planned acquisition in order to obtain legal certainty at an early stage. The certificate of non-objection confirms that the acquisition does not raise any concerns related to public order or security. The written application shall include basic information on the planned acquisition, the domestic company that is the subject of the acquisition, and the respective fields of business.

If the Economic Affairs Ministry does not open a review within two months from the receipt of the buyer’s written application for a certificate of non-objection, the certificate shall be deemed to have been issued (Section 58 Subsection 2 of the Foreign Trade and Payments Ordinance).

In the event that a review procedure is opened, the buyer shall be obligated to provide the Economic Affairs Ministry with all the relevant documents for the review. Detailed information on this was published in the Federal Gazette (Bundesanzeiger) on 2 September 2013 by means of a general order. Furthermore, the Economic Affairs Ministry may request additional documents for the review. The acquisition may be restricted or prohibited only within four months after the full set of documents has been submitted.

During the review period, the legal transaction on which the investment is based shall be effective. However, the acquisition shall be subject to the condition subsequent of the acquisition being prohibited (Section 15 subsection 2 Foreign Trade and Payments Act).

The Economic Affairs Ministry is responsible for the implementation of the review procedure. It shall involve other federal ministries concerned in the particular case within the scope of their respective competences. The issuance of orders or prohibitions requires the consent of the entire Federal Government. This provision underlines the exceptional character of restrictions or prohibitions of foreign direct investments.